excise tax nc real estate

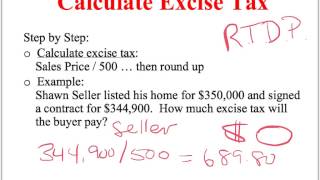

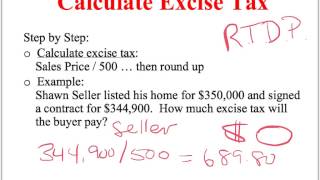

In addition to County and municipal tax your tax bill may also include the following. The current tax rate is 100 per 500.

Calculating Excise Tax Help With Closing Statments Youtube

There will also be a new 1 excise tax imposed on stock buybacks raising some.

. Indicate amount of excise tax to be paid at time of recording 1 per 500 or 2 per 1000 of consideration or purchase price Grantees mailing address. Extends the four-cent-per-gallon partial exemption from the motor fuels excise tax through September 30 1988. Denver CO Real Estate Agents.

North Carolina has 1012 special sales tax jurisdictions with local sales taxes in. Cincinnati OH Real Estate Agents. A single-family home would normally have.

For this purpose an estate or trust is considered a resident of any state that taxes the trust or estate based on its net income. This Article applies to every person conveying an interest in real estate located in North Carolina other than a governmental unit or an instrumentality of a governmental unit. When couples share real estate as community property too real estate automatically passes upon death.

Dallas TX Real Estate Agents. Charlotte NC Real Estate Agents. However a tax stamp at the rate of 2 for every 1000 in value is affixed.

443 6 490 1 342 25 2. In recording deeds the state of North Carolina does not require that the amount paid for a parcel be stated on the deed. Attorneys Banks Credit Unions Financial Advisors Car Insurance Insurance Agents Mortgage Providers Real Estate Agents.

The credit is limited to. If you reside in one of Wake Countys 16 cities or towns your municipal property taxes are included in the property tax bill you receive from Wake County. Real Estate Investment Trusts - Modifies the provisions relating to the requirements for qualifications as a real estate investment trust to provide that an.

Be informed and get ahead with. How is NC state income tax listed at 2. If the family is eligible for Medicaid everyone can get Medicaid.

Which is better for estate planning - a will or a trust. Among the tax hikes that will fall on households making less than 400000 is the IRAs new 1 excise tax on the value of stock buybacks. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

Property will be checked for delinquent taxes OR deed must contain a licensed NC attorneys tax statement. Service Center 2nd Floor 633 Court Street Reading PA 19601 610 478-6625. Pay Delinquent Real Estate Tax Bill Online.

North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median property tax than North Carolina. If a parent is a dependent they can be part of a family plan and thus share tax credits which can be given in advance but are technically filed for on tax form 8962. Venture capital real estate partnerships and their portfolio companies which together account for over 25 million American jobs.

Transfer andor excise tax. Reduces the excise tax exemption for qualified methanol and ethanol fuels. An excise tax is levied on each instrument by which any interest in real property is conveyed to another person.

Homes 7 bedroom 5 bathroom by owner swimming pool qr code link to this post we have city lots to buld your dream home only 249k at city of petaluma with big home with pool and zacuzi etc zip 94952 at sant rosa the newer home 5000 squre feet 5-7br 5 bath at zip 95404 also 180 acres at zip code 95986 only 2999 acre write info at google all info there 1 million apraze with water all. While taxpayers in the bottom four quintiles would see an increase in after-tax incomes in 2021 primarily due to the temporary CTC expansion by 2030 the plan would lead to lower. It will be replaced by a new excise.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Iredell County real estate transactions. Car Loans Home Equity Loans Mortgages.

The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. Appraisal of Real Property in New Hanover County NC North Carolina General Statute 105-274 states that all real and personal property located within its jurisdiction shall be subject to taxation unless it is otherwise exempted or excluded from taxation. Hearings office administration dept administrative code administrative rules adoption advertising marketing agricultural finance authority.

The current Official Payments online credit card system will shut down on December 31 2019. Content required for Other Papers. 13144 Modifies exceptions to the exclusion of real property acquired by a qualified organization from the meaning of acquisition indebtedness.

13161 Repeals the luxury excise tax on boats aircraft. The deceased spouses or domestic partners interest fully passes to the surviving co-owner. Previous tax rates were.

Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75. The proportion of the tax paid to the other state by the estate or trust that the double-taxed income. Recycling Fees Charged per living unit on the property.

View Commissioners Resolution 110510. Bidens tax plan is estimated to raise about 333 trillion over the next decade on a conventional basis and 278 trillion after accounting for the reduction in the size of the US. New credit card system.

Total Sales Excise Tax Burden 1. Democrats would impose a 95 percent excise tax on prescription drugs unless drug manufacturers accept government-set prices. Please be advised that our office is in the process of implementing a new delinquent tax system and.

13143 Provides for the treatment of rental real estate activities under the limitations on losses from passive activities. As a rule of thumb you want your coverage family and tax family to be the same. North Carolinas median income is 55928 per year so the median yearly property tax paid by.

The new corporate minimum tax would kick in after the 2022 tax year and raise more than 258 billion over the decade. A lack of probate affidavit and an excise tax affidavit to report the legal non-taxable transfer of ownership to the tax authorities. 66 when NC has flat.

Excise Tax on Conveyances. Prescription Drugs are exempt from the North Carolina sales tax. 95 Percent Tax on Prescription-Drugs to Force Price Controls 288 Billion.

Real Estate Math For New Agents Real Estate Exam Real Estate Marketing Plan Real Estate Test

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Wake County North Carolina Property Tax Rates 2020 Tax Year

Property Taxes In Nassau County Suffolk County

Samuel Seaney Discovered In U S Irs Tax Assessment Lists 1862 1918 Irs Taxes Assessment Irs

Tax Assessment Buncombe County Asheville

Proposed Increase In Real Estate Excise Tax Results In Outpouring Of Public Input News Dailyrecordnews Com

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Excise Tax Real Estate Exam Prep For North Carolina Youtube

Calculating Excise Tax Help With Closing Statments Youtube

Ultimate Excise Tax Guide Definition Examples State Vs Federal

North Carolina Tax Reform North Carolina Tax Competitiveness

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)